Estate Planning: Three Ways to Guide Charitable Conversations

As trusted advisors, you regularly guide your clients through estate planning conversations—updating wills, trusts, and financial plans as life circumstances evolve. Yet, despite your steady reminders, estate planning often remains a deferred priority for many clients.

National Estate Planning Week, observed in 2025 from October 20 to 26, is an ideal opportunity to revisit these conversations. It’s a timely moment to help clients consider not only how their assets will be distributed to heirs, but also how their legacy can support the causes they care about most.

Donor advised funds (DAFs) can be a powerful tool in this process—offering clients a flexible, tax-efficient way to incorporate charitable giving into their estate plans. Whether used to leave a lasting philanthropic legacy or to engage future generations in giving, DAFs provide a streamlined solution that aligns with both financial and charitable goals.

Why Estate Planning Conversations Matter

1. National Estate Planning Week encourages critical client reviews.

This week can serve as an effective prompt for clients to revisit their estate plans with fresh eyes, especially regarding provisions for charitable giving. Many clients may not have considered the full potential of including charitable gifts in their legacy. You don’t have to be a subject matter expert, we’re here to help.

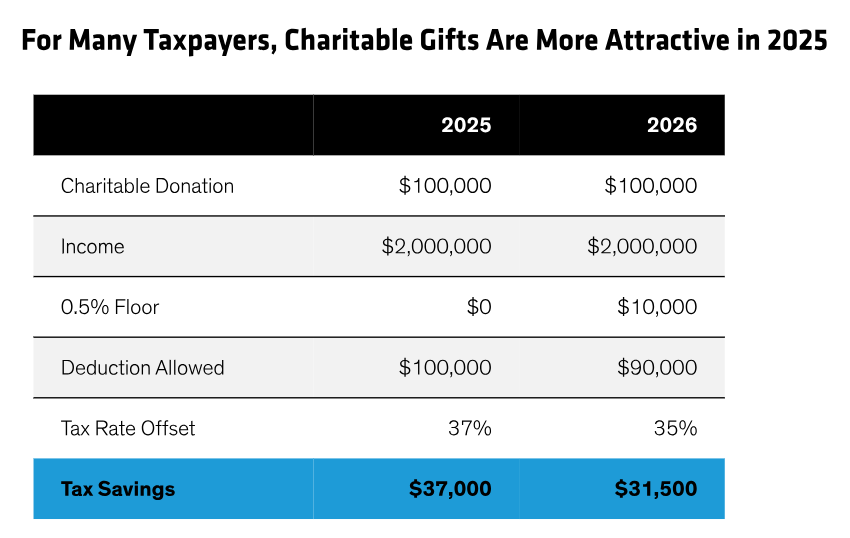

2. The tax landscape and DAF opportunities are evolving.

Changes under the One Big Beautiful Bill Act have shifted the rules around charitable deductions and itemizing, creating new opportunities to maximize giving through donor advised funds—particularly for high-net-worth individuals looking to accelerate charitable contributions before specific changes take effect next year.

Three Practical Steps to Engage Your Clients

Step 1: Introduce the implications of the One Big Beautiful Bill Act (OBBBA).

Use this legislation as a starting point to explain how clients can optimize their tax deductions by establishing or contributing to a donor advised fund at the Community Foundation. This approach can be especially valuable for clients who have been unsure about itemizing deductions in recent years.

Step 2: Discuss charitable legacy planning as part of estate planning review.

Encourage clients to revisit their wills, trusts, and beneficiary designations to confirm or establish charitable gifts. For those who regularly support nonprofits, it may be timely to evaluate whether incorporating a planned gift aligns with their broader legacy goals. We can help them create a customized legacy plan that honors their favorite causes and ensures their generosity lives on for generations to come.

Step 3: Leverage the Community Foundation’s expertise and resources.

Partner with us to offer your clients a comprehensive charitable giving strategy that complements their financial, charitable, and estate plans. From donor advised funds to noncash assets and estate gift documentation, we help you deliver a coordinated philanthropic plan that reflects your client’s values and goals.

Continue reading: In Uncertain Times, Charitable Giving Matters More Than Ever

How the Community Foundation Supports Advisors & Clients

Greater Houston Community Foundation is a local philanthropic partner with deep insight into community needs and nonprofit effectiveness. By collaborating with us, you can enhance your client service offering by integrating philanthropy as a strategic component of wealth and estate planning.

The Community Foundation provides:

- Customized philanthropic solutions aligned with your clients’ financial and legacy goals.

- Expert guidance on navigating tax and regulatory changes that affect charitable giving.

- Professional stewardship of charitable assets to ensure long-term impact.

- Tools and strategies to help clients achieve meaningful, effective community impact.

- The ability to accept a wide range of non-cash assets — including appreciated securities, real estate, business interests, and more — to maximize tax benefits and charitable outcomes.

Engage With Us Today

As you continue conversations sparked by year-end giving and financial planning, we invite you to reach out and explore how the Greater Houston Community Foundation can serve as an extension of your advisory team. Together, we can help your clients achieve their financial, charitable, and legacy goals with confidence and clarity. Partner with Greater Houston Community Foundation today to help your clients give with impact, purpose, and confidence. Contact Andrea Mayes, Senior Director of Charitable Solutions, to get started.

Additional Resources:

- Learn more about the Community Foundation’s services and how we can support your clients’ philanthropic goals.

- Join our professional advisor mailing list to stay up-to-date on the latest news and insights from the Foundation.

More Helpful Articles by Greater Houston Community Foundation:

- Donor Advised Funds Tax Benefits

- Integrating Philanthropy into High-Income Tax Planning

- DAFs & Private Foundations: Addressing Common Misconceptions

- Philanthropy Made Easy: 3 Essential Donor Advised Fund Rules

- Maximizing Corporate Philanthropy

This website is a public resource of general information that is intended, but not promised or guaranteed, to be correct, complete, and up to date. The materials on this website, including all comments and responses to comments, do not constitute legal, tax, or other professional advice, and is not intended to create, and receipt or viewing does not constitute, nor should it be considered an invitation for, an attorney-client relationship. The reader should not rely on information provided herein and should always seek the advice of competent legal counsel and/or a tax professional in the reader’s state or jurisdiction. The owner of this website does not intend links on the website to be referrals or endorsements of the linked entities.