The Great Tax Sunset: What Donors Need to Know

Key Insights & Important Giving Implications

Greater Houston Community Foundation is Houston’s philanthropic partner and puts donors at the center of everything we do. Within the next several years, important tax provisions will emerge that may influence how donors and clients navigate their philanthropic endeavors.

The Foundation is here to support professional advisors and their clients in navigating the complexities of these changes. Greater Houston Community Foundation can help create a strategy that creates the most meaningful impact for both the donor and the community.

What is the Tax Cut and Jobs Act 2017 (TCJA)?

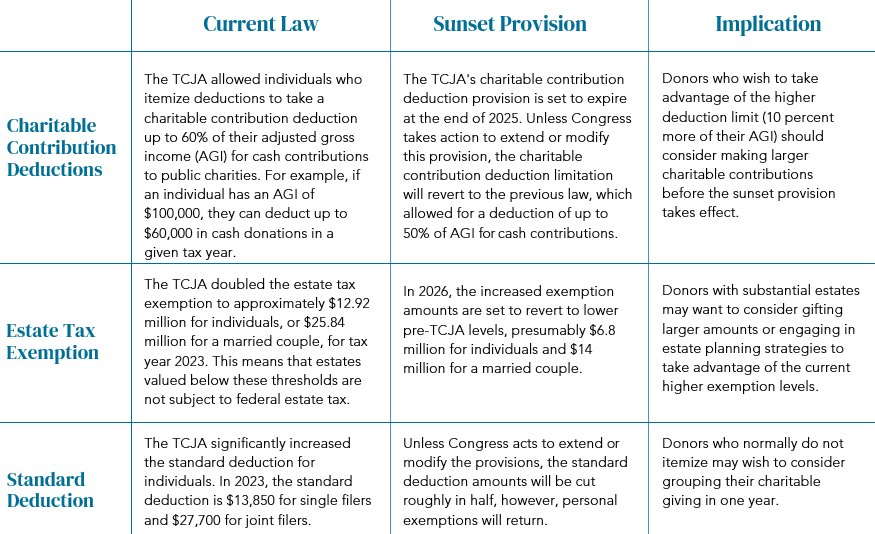

The TCJA is a landmark tax reform act that introduced several key changes impacting both individuals and corporations. Among these changes are alterations to deductions, rates, and exemptions, which may affect an individual’s financial outlook. One notable feature of the TCJA is the inclusion of “sunset” provisions, which means that some of the Act’s provisions are set to expire after a certain period.

For professional advisors and their clients, understanding these changes is crucial for informed decision- making. The sunset provision implies that certain tax benefits associated with charitable giving may be subject to change in the future. While we cannot predict with certainty the exact impact this may have, it underscores the importance of considering a proactive and strategic approach to your giving.

Greater Houston Community Foundation does not provide tax advice or services. Please consult your personal advisor with questions regarding your tax planning.

More Helpful Articles by Greater Houston Community Foundation:

- How to start a scholarship fund?

- The Importance of Charitable Giving in Financial and Estate Planning

- 3 Tips for Keeping Your Advisors in the Loop for Maximum Impact

- Combating Human Trafficking in Houston: Jennifer Hohman’s Fight for Justice

This website is a public resource of general information that is intended, but not promised or guaranteed, to be correct, complete and up to date. The materials on this website, including all comments and responses to comments, do not constitute legal, tax, or other professional advice, and is not intended to create, and receipt or viewing does not constitute, nor should it be considered an invitation for, an attorney-client relationship. The reader should not rely on information provided herein and should always seek the advice of competent legal counsel and/or a tax professional in the reader’s state or jurisdiction. The owner of this website does not intend links on the website to be referrals or endorsements of the linked entities.