Donating closely traded stock to Greater Houston Community Foundation (Foundation) is a strategic and impactful way to support charitable causes while optimizing your financial portfolio. With the Foundation as your philanthropic partner, you can effortlessly transform your assets into meaningful contributions that make a lasting difference in our community.

Benefits

• By donating closely traded stock, you may be eligible for significant tax benefits, including deductions for the fair market value of the stock and potential avoidance of capital gains tax.

• Donating closely traded stock allows you to diversify your investment portfolio while simultaneously supporting causes you care about, aligning your financial goals with your philanthropic vision.

Our experienced team is here to streamline the process, making your giving journey seamless and rewarding.

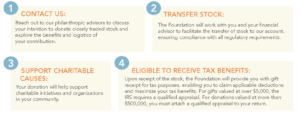

How It Works

Experience the transformative power of philanthropy by donating closely traded stock to Greater Houston Community Foundation. With our expertise and dedication, we make it easy for you to turn your assets into lasting impact. Contact us today to start your journey towards meaningful giving and leave a legacy of generosity that resonates for generations to come.