Investing in philanthropy is not limited to cash donations. Donating appreciated securities, including shares of stocks, bonds, mutual funds, or exchange-traded funds (ETFs), that you transfer to the Greater Houston Community Foundation prior to sale may be eligible for a fair market value deduction and avoids capital gains tax. Discover the power of donating publicly traded stocks and bonds to the Foundation and maximize the impact of your charitable giving.

Benefits

• Avoid paying long-term capital gains tax on the sale of appreciated stock.

• Eligible to claim a fair market value charitable deduction for the tax year in which the gift is made.

Efficiency & Convenience

• Leverage appreciated securities for a tax-smart donation.

• Streamline your giving by transferring securities prior to sale to maximize tax benefits and avoid capital gains tax.

• Streamline your giving by contributing publicly traded securities directly to your donor advised fund.

• The Foundation handles the liquidation process, making it hassle-free for you.

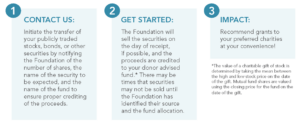

How It Works

In partnering with Greater Houston Community Foundation, you’re not just donating; you’re igniting meaningful change in our community. With our expertise and support, giving stocks and bonds has never been easier or more impactful. Let us guide you through the process, ensuring that your generosity makes a lasting difference where it’s needed most. Together, we can create a brighter future for all.