What Is the Great Wealth Transfer?

The financial landscape of the 21st century is undergoing a seismic shift, one that has far-reaching implications for families, economies, and philanthropy at large. The “great wealth transfer” is expected to be an unprecedented movement of assets across generations that will reshape how generational wealth is managed, distributed, and preserved long into the future.

Over the next several decades, trillions of dollars will change hands as baby boomers pass down their hard-earned wealth to younger generations. This monumental shift is not just about numbers—it’s about values, legacies, and the massive responsibility of ensuring that wealth is used to foster growth and create a meaningful impact.

Greater Houston Community Foundation is here to dive into the great wealth transfer to explore its implications and the steps families can take to prepare for this historic transition. Ready to get prepared? Whether you are a wealth holder or an heir, call us at 713-333-2210 today to get started.

Key Insights

- Over the next few decades, baby boomers will transfer an estimated $84 to $124 trillion in assets to younger generations and charitable causes, marking a historic and unprecedented financial shift.

- Factors driving this phenomenon include an aging baby boomer population, decades of wealth accumulation through economic growth and investments, and changing family dynamics that complicate inheritance planning.

- The wealth transfer will reshape economies, influencing consumer spending, investment trends, and philanthropy.

- Proper estate and financial planning are essential to manage generational wealth transfers, prevent tax liabilities, and align asset distribution with personal values. Tools like wills, trusts, and charitable giving strategies play a key role.

- Wealth holders can prepare by developing comprehensive estate plans, promoting financial literacy, and fostering open family discussions about wealth.

- Heirs should educate themselves on financial management, understand their responsibilities, and work with trusted advisors.

Table of Contents

- What is the great wealth transfer?

- The current landscape

- Projected great wealth transfer statistics

- What is causing the great wealth transfer?

- Implications of the great wealth transfer

- Transferring wealth and estate planning

- Preparing for the great wealth transfer

- Transferring wealth? The Foundation can help!

What is the great wealth transfer?

The great wealth transfer refers to the massive movement of wealth anticipated to occur as baby boomers, the largest generational demographic in history, pass down their assets to the next generations. This transfer of wealth, expected to total trillions of dollars over the coming decades, is unprecedented in scope and significance.

This wealth shift is poised to reshape economies, fundamentally change philanthropy, and impact societal views on financial responsibility. As families prepare for this monumental transfer, understanding its implications and preparing accordingly is essential for ensuring that generational wealth is preserved, utilized wisely, and aligned with the values and aspirations of both wealth holders and their heirs.

The current landscape

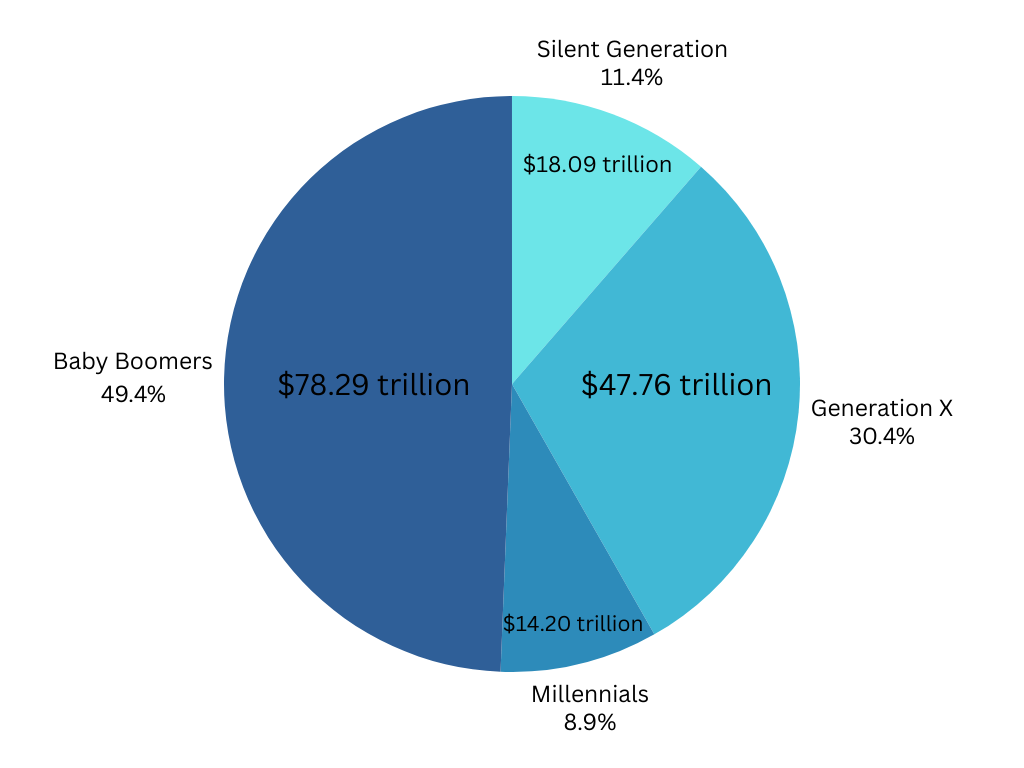

How did we get here? Baby boomers experienced a period of significant economic expansion, which enabled them to amass considerable wealth through real estate investments, unprecedented stock market growth, and entrepreneurial ventures. Today, baby boomers control about half of the wealth in the United States.

As they age, their transition into retirement and beyond has created an unprecedented financial windfall. However, the value of the assets expected to be transferred has yet to be seen, and projections only seem to grow.

Projected great wealth transfer statistics

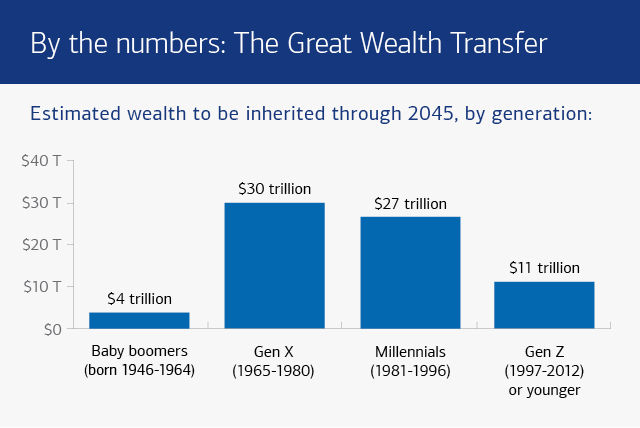

Initial projections from Cerulli Associates predicted that the great wealth transfer would total around $84 trillion through 2045. Younger generations (Generation X, millennials, and Generation Z) were predicted to inherit around $72 trillion, with the remaining $12 trillion going toward philanthropy.

This is already an almost unfathomable amount of wealth, but according to a more recent Cerulli report, up to $124 trillion in wealth is anticipated to be transferred by 2048.

What is causing the great wealth transfer?

This massive transfer of wealth and its implications is a confluence of several disparate factors.

- An aging population. Baby boomers are entering their twilight years, necessitating the transition of their accumulated assets to heirs or charitable causes. This demographic shift is the primary driver of the wealth transfer phenomenon.

- Unprecedented wealth accumulation. Baby boomers benefited from decades of economic growth, technological innovation, and real estate appreciation. Their investments in stocks, bonds, and businesses have created substantial nest eggs that now need to be passed down.

- Changing family structures. Modern families are more diverse, with blended families, single-parent households, and nontraditional arrangements becoming increasingly common. These evolving dynamics add significant complexity to inheritance planning and wealth distribution.

Implications of the great wealth transfer

While the great wealth transfer will have far-reaching implications for individuals, families, and society at large, there are a few primary changes expected.

- Economic changes. The influx of inherited wealth is poised to significantly impact consumer spending, investment patterns, and market dynamics. Younger generations are likely to channel these funds into starting businesses, investing in sustainable industries, or purchasing real estate, potentially leading to rapid modernization across various markets.

- Changes in social dynamics. Societal attitudes toward wealth and responsibility are shifting, with an increasing emphasis on using financial resources to address social and environmental challenges. Social responsibility has increased in popularity over the last few decades already. This is expected to continue and possibly increase exponentially.

- Shifts in the philanthropic landscape. The transfer is expected to fuel unprecedented levels of charitable donations. There are several reasons for this, but the primary one is charitable giving’s usefulness when transferring an estate.

The great wealth transfer and estate planning

Estate planning and charitable giving are deeply connected, and effective estate planning is critical to navigating the complexities of any wealth transfer. Families risk significant tax liabilities, legal disputes, and financial mismanagement without proper planning.

Some important considerations for estate planning before the passing down of generational wealth include:

- Creating or updating wills and trusts to ensure assets are distributed according to the wealth holder’s wishes

- Incorporating charitable giving into estate plans to align with personal values and reduce tax burdens

- Establishing clear communication channels within families to help ensure alignment moving into the future

It is always advisable to consult with a qualified tax professional who can offer personalized guidance tailored to your specific circumstances and objectives.

Continue reading about legacy planning and tax strategies for charitable giving

Preparing for the great wealth transfer

Preparation is crucial for both wealth holders and their heirs to ensure a seamless and successful transfer of assets. So, how can we prepare for this seismic event? Taking a few proactive steps now can help mitigate potential challenges in the future, and maximize the possibilities of inherited wealth.

How can wealth holders prepare for the great wealth transfer?

- Develop a comprehensive estate plan: Work with financial advisors and estate planning professionals to create a plan that reflects personal values and financial goals.

- Engage in family discussions: Open communication with heirs about the values, responsibilities, and intentions behind the wealth transfer can help prevent misunderstandings and conflicts—it can also help encourage next-gen philanthropy for generations to come.

- Promote financial literacy: Educating family members about financial management, investment strategies, and philanthropic opportunities ensures they are well-prepared to handle inherited assets.

- Prioritize charitable giving: Establishing donor advised funds, charitable trusts, or foundations can help wealth holders leave a lasting impact on causes they care about.

How can younger generations and family members prepare for the great wealth transfer?

As we navigate this significant transfer of wealth, younger generations and family members need to equip themselves with the necessary skills and knowledge to manage this responsibility effectively. This transition presents unique challenges and opportunities that require thoughtful preparation and engagement. The Foundation can play a vital role in this process, ensuring that heirs are informed, empowered, and aligned with their family’s values. Here are a few key strategies to consider:

Stay educated. With the guidance of wealth holders, heirs should prioritize financial literacy, encompassing budgeting, investing, and tax planning.

- How can the Foundation help? We can support this educational journey through initiatives like the Next Gen Donor Institute, which offers valuable programs and resources tailored to the next generation of philanthropists.

Understand your role. Inheriting wealth comes with responsibilities, including preserving assets, aligning traditional family values with personal beliefs, and considering the ramifications of financial decisions on future generations.

- How can the Foundation help? Our experienced team of philanthropic advisors can facilitate discussions around family values and the significance of responsible wealth stewardship, helping to create a shared vision that resonates with both current and future generations.

Rely on your advisors. Younger family members inheriting wealth should establish relationships with trusted financial and legal professionals who can help deal with the extra responsibilities, and help bear the burden of generational wealth.

- How can the Foundation help? The Foundation can play a pivotal role as your trusted philanthropic partner, working seamlessly with your team of financial and legal advisors.

How can women prepare? The female factor at play in the great wealth transfer.

Women are expected to play a big role in the next two decades of wealth being transferred, as they are likely to outlive their spouses and inherit substantial portions of family wealth. This is another demographic shift taking place at the heart of these larger shifts, presenting even further opportunities for change. Gen X and millennial women should prepare to take lead roles in family financial planning, advocate for causes that are close to them, and develop relationships with key advisors.

Continue reading:

Preparing for the great wealth transfer? The Foundation can help.

Greater Houston Community Foundation is uniquely positioned to support families as they navigate the transfer of generational wealth. We can help your family align values, set goals, and implement philanthropic strategies designed to help you pass down your wealth and leave your legacy.

The great wealth transfer represents both an opportunity and a responsibility for families to shape their financial legacies thoughtfully. By taking proactive steps and leveraging the expertise of a community foundation, wealth holders and their heirs can help ensure a smooth transition of assets while making a positive impact on future generations.

If you’re ready to get serious about philanthropic financial planning and start shaping your family’s legacy, call Greater Houston Community Foundation today at 713-333-2210 or reach out directly to get started.

This website is a public resource of general information that is intended, but not promised or guaranteed, to be correct, complete and up to date. The materials on this website, including all comments and responses to comments, do not constitute legal, tax, or other professional advice, and is not intended to create, and receipt or viewing does not constitute, nor should it be considered an invitation for, an attorney-client relationship. The reader should not rely on information provided herein and should always seek the advice of competent legal counsel and/or a tax professional in the reader’s state or jurisdiction. The owner of this website does not intend links on the website to be referrals or endorsements of the linked entities.

More Helpful Articles by Greater Houston Community Foundation:

- What to Do with an Inheritance

- The Power of Collective Giving

- 5 Tips to Foster a Love for Philanthropy in Children

- How Does a Donor Advised Fund Work?

- Understanding DAFs: A Comprehensive Guide for Nonprofits