The Surprising Benefits of Philanthropy on Your Well-being

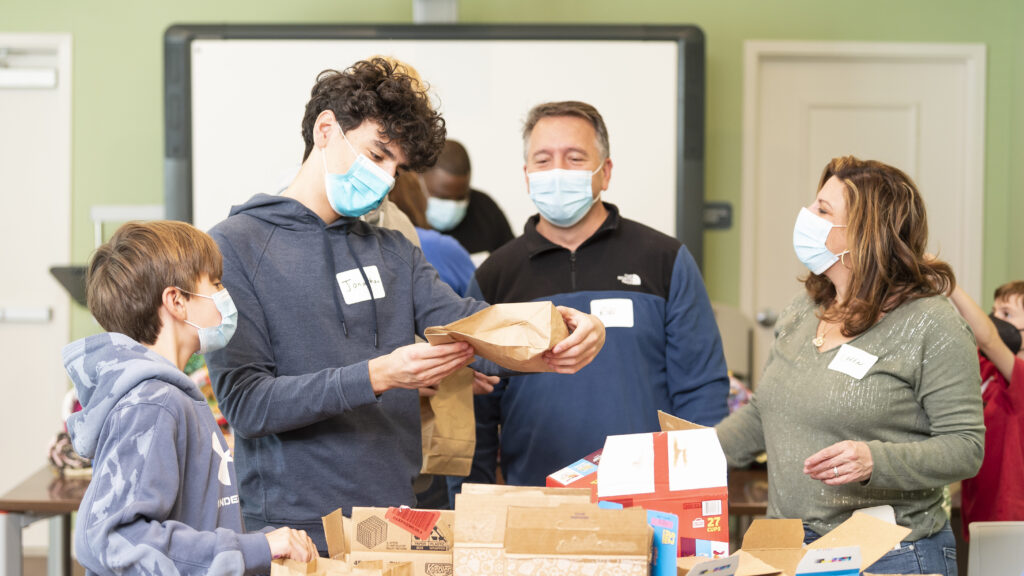

The phrase “philanthropy” is often associated with selfless acts of kindness, but what if we told you that doing good can benefit you too? What are the benefits of philanthropy? Giving back can create a powerful cycle of positive impact for both donors and the communities they serve—and the Community Foundation can help you do it.

At Greater Houston Community Foundation, we believe that philanthropy is a powerful force for good. Our mission is to empower individuals and families to make a difference in their communities by providing resources, expertise, and support to help them achieve their philanthropic goals. Whether you’re looking to give back to your community, support a specific cause, or make a lasting impact on the lives of others, we’re here to help you achieve your goals through family philanthropy and strategic giving.

What are pros to charitable giving? The benefits of “doing good.”

So, how does philanthropy impact our well-being? The answer is simple: giving back to others can have a profound impact on our mental and physical health. Research has shown that people who engage in acts of kindness experience a surge in endorphins, which are natural mood boosters. Additionally, giving can help reduce stress and anxiety, improve our sleep quality, and boost our self-esteem.

These philanthropic activities also provide donors with a deeper sense of purpose while contributing to long-term change in their communities. The Community Foundation is committed to helping individuals and families experience these benefits for themselves.

Contrary to the common notion that giving should come at a personal cost, studies have shown that philanthropy can have numerous benefits for both the giver and the receiver.

Here are just a few examples of the health benefits and quality of life improvements:

- Volunteering for just four hours a week can reduce the risk of high blood pressure by 40% in adults over 50.

- Giving can lower cortisol levels, reducing stress and anxiety.

- Unselfishness has been linked to a lower risk of early death due to stress-related mortality.

- Engaging in altruistic activities releases endorphins, boosting our mood and overall well-being.

- A positive work culture that encourages philanthropy can increase productivity and job satisfaction.

- Practicing gratitude for the good we’ve done can improve our sleep quality and overall sense of happiness.

- Even doing just one good deed a week can lead to increased happiness over time.

Benefits of philanthropy to society and individual impact

Beyond personal satisfaction, donors can also benefit from charitable giving tax deductions and reduced tax liability when making charitable contributions strategically. Taking a strategic approach to giving not only transforms communities but also provides donors with greater fulfillment and purpose.

Personal financial benefits of giving can include:

- Significant tax deductions that can reduce your annual tax liability

- Estate tax benefits for legacy planning and wealth transfer

- Capital gains tax avoidance when donating appreciated assets

- Enhanced financial planning opportunities through charitable vehicles

- Potential for creating family foundations that preserve generational wealth

Benefits to society can include:

- Funding innovative solutions for complex social problems

- Supporting nonprofits that create lasting community infrastructure

- Advancing education, healthcare, and social services in underserved areas

- Fostering civic engagement and community leadership development

- Catalyzing social change through strategic, coordinated giving efforts

For those interested in maximizing their impact, the tax benefits of charitable donations can help optimize both financial and philanthropic goals. High-net-worth individuals particularly benefit from incorporating charitable giving and financial planning, which can align and improve their overall financial plans.

The health benefits of reflection

But what about the benefits of reflecting on our own philanthropic activities? A staggering 92% of people who take the time to reflect on their good deeds report feeling better about themselves. This is because thinking about what we’ve given to others can be a powerful motivator, driving us to continue doing good things for others.

The Community Foundation can help you unlock the power of philanthropy

At the Community Foundation, we believe that philanthropy is not only about giving back to the community but also experiencing the positive impact it can have on our own lives. That’s why we’re committed to helping individuals and families, businesses, and private foundations make a difference in the causes they care about, while also improving their own well-being.

We specialize in high-net-worth philanthropy, and can help your family unite to meet your philanthropic goals, whether those be preserving generational wealth or mapping out your legacy.

Whether you’ve already established a donor advised fund or are just starting, we invite you to join us in exploring the many ways that philanthropy can benefit both you and those you care about. Together, let’s make a difference in our community and experience the joy and fulfillment that comes with doing good. Call us at 713-333-2210 or reach out directly to get started.

More Helpful Articles by Greater Houston Community Foundation:

- What Is the Great Wealth Transfer?

- How To Get Started with Legacy Giving

- The Power of Collective Giving

- What to Do with an Inheritance

- How To Integrate Charitable Giving and Legacy Planning

This website is a public resource of general information that is intended, but not promised or guaranteed, to be correct, complete, and up to date. The materials on this website, including all comments and responses to comments, do not constitute legal, tax, or other professional advice, and is not intended to create, and receipt or viewing does not constitute, nor should it be considered an invitation for, an attorney-client relationship. The reader should not rely on information provided herein and should always seek the advice of competent legal counsel and/or a tax professional in the reader’s state or jurisdiction. The owner of this website does not intend links on the website to be referrals or endorsements of the linked entities.