Values & Valuables: A Three-Part Series on Empowering Generations Through Philanthropy

As we look ahead to a significant change on the horizon, many families across the nation find themselves pondering a question that resonates deeply: How do we pass down not just our wealth, but the values that truly matter? The coming decades promise a dramatic shift as the “great wealth transfer” unfolds, bringing with its trillions of dollars passed from baby boomers to their children and grandchildren. But this moment is far more than financial transactions; it’s an invitation to have heartfelt conversations about the principles that shape our lives and our legacies.

At Greater Houston Community Foundation, we understand that the true importance of wealth lies in what we do with it—and what we stand for. As families prepare to navigate this significant transfer of assets, it’s essential to engage with future generations about the values, traditions, and beliefs that define us. How do we ensure that our legacies go beyond financial wealth to inspire philanthropy and responsible stewardship?

Today, families come in all shapes and sizes, reflecting a tapestry of dynamics that differ significantly from the traditional “Leave It to Beaver” archetype. Whether it’s blended families, single-parent homes, or chosen families formed among friends, the rising generation embodies a rich variety of perspectives and experiences.

In this three-part series, we will share data, insights, and stories on how to cultivate open, meaningful conversations, empowering this next generation to honor their loved one’s legacy, nurture lasting relationships, and become stewards of their own values in an ever-evolving world.

National Trends in Giving

According to a recent report by Cerulli Associates, wealth transferred in the United States through 2048 is projected to reach an unprecedented $124 trillion. Of this, $105 trillion is expected to flow to heirs—children, grandchildren, and other beneficiaries—while an estimated $18 trillion will be directed toward charitable causes. This moment marks one of the largest intergenerational wealth transfers in modern history and presents an extraordinary opportunity to redefine the future of philanthropy.

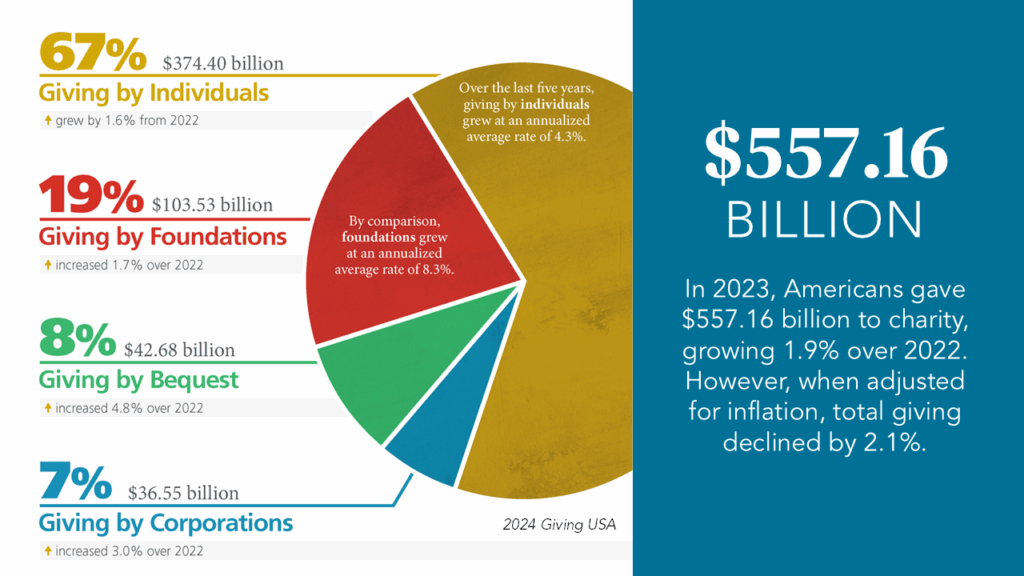

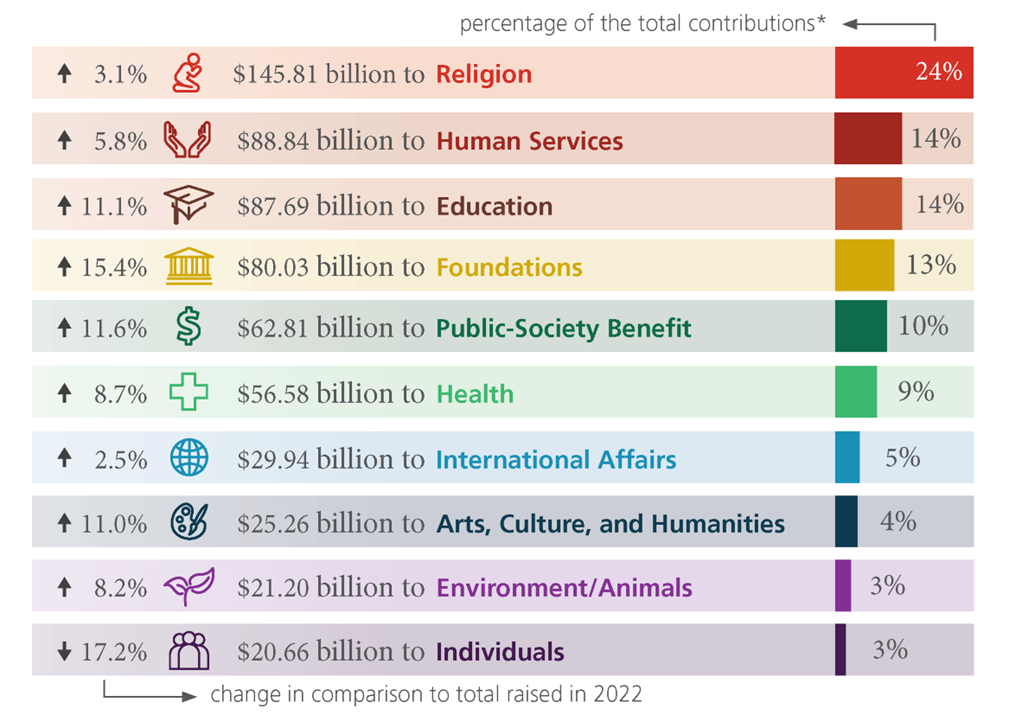

According to Giving USA 2025, charitable giving in the United States reached a record $557.16 billion in 2024, a 1.9% increase from the previous year, though giving declined by 2.1% when adjusted for inflation. Individuals remained the largest source of giving, contributing 67% of the total, followed by foundations (19%), bequests (8%), and corporations (7%). Bequest and corporate giving outpaced inflation, while foundation and individual giving fell slightly in real terms.

These findings underscore how generational giving is reshaping philanthropy—not only in who is giving, but in how and why they give. As trillions of dollars shift to younger, more values-driven donors, the focus is moving toward strategic, equity-centered, and impact-oriented giving that reflects both personal identity and community responsibility.

A New Era of Wealth—and Responsibility

This massive shift in financial power is poised to reshape the philanthropic landscape for decades to come. Millennials, often referred to as the Rising Generation, are expected to become five times as wealthy as their parents by 2030, making them the wealthiest generation in American history. But this generation brings not only new wealth—it brings new values, new expectations, and a more strategic, impact-driven approach to giving.

Millennials and Gen Z donors are more likely than previous generations to:

- Prioritize transparency, equity, and community-centered solutions

- Support organizations aligned with their values, especially around racial justice, climate, and mental health

- Engage directly with causes—through advocacy, volunteering, and participatory philanthropy

- Favor trust-based giving and general operating support over restricted project funding

- Involve themselves in social entrepreneurship and blended giving models (e.g., impact investing, ESG strategies)

Concerns on the Horizon?

While the great wealth transfer represents an extraordinary opportunity to reshape philanthropy, it also brings significant challenges that families, advisors, and nonprofits must acknowledge and address with care. Despite the magnitude of this transfer, warning signs are clear:

Heirs Often Feel Unprepared

RBC Wealth Management reports that 54% of heirs feel unprepared to handle their inheritance. Without financial literacy, philanthropic guidance, or family dialogue, beneficiaries may struggle to manage assets wisely—potentially jeopardizing both financial stability and charitable legacy.

Wealth Erosion Across Generations

According to a recent study, a staggering 90% of family wealth is lost by the third generation. The primary culprits? Inflation, taxes and lack of ‘spending discipline’ can be detrimental. These losses don’t just represent disappearing assets—they often mean the disappearance of meaningful, values-based giving.

Fractured Families

The biggest threat to lasting wealth might not be money at all—it’s family. Why doesn’t wealth typically survive past a few generations? According to the Williams Group, a breakdown of trust and communication within the family. Fights over fairness, control, or differing visions for how money should be used can destroy both relationships and fortunes.

Advisor Turnover and Fragmented Legacy Plans

An estimated 60% of heirs switch financial advisors after inheriting wealth. This break in continuity can disrupt long-term philanthropic plans, reduce trust in giving vehicles like donor advised funds, and weaken institutional memory tied to family values and charitable goals.

Generational Misalignment

Rising generations often prioritize transparency, equity, and innovation—values that may contrast with traditional approaches to philanthropy. While this evolution can invigorate giving, it can also lead to tension or disengagement if not addressed through intentional, inclusive conversations.

Failure to Plan for Succession

Many families still lack clear succession plans for their philanthropic efforts. Without named successors on donor advised funds, documented legacy intentions, or a structure for inclusive giving, charitable capital may become directionless—or worse, unused.

Exploring Houston’s Growing Wealth Landscape

Let’s dive into Houston, one of the fastest-growing major cities in the world, where wealth continues to thrive. This isn’t just about inherited money—Houston is becoming a hotspot for new wealth creation, and the statistics speak for themselves.

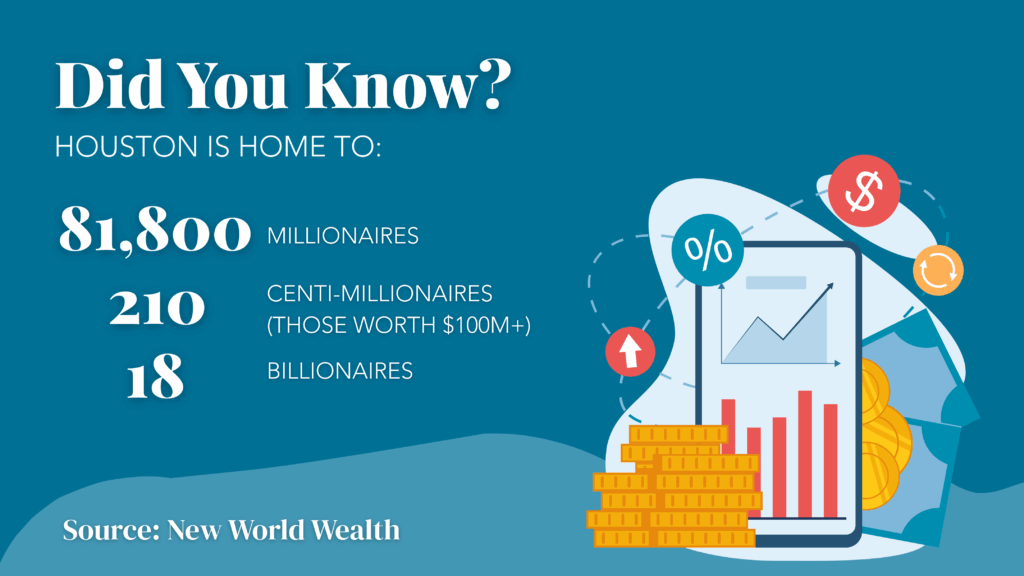

Did you know that Houston is home to approximately 81,800 millionaires? That places it fifth among U.S. cities with the most millionaires. The city’s economic landscape is dotted with 210 centi-millionaires (those worth $100 million or more) and 18 billionaires, with Texas boasting a total of 84 billionaires. It’s a vibrant hub of financial prosperity.

As Houston continues to grow and evolve, it stands as a testament to innovation and opportunity—a place where new money is being generated and shared for the greater good. Whether you’re already part of this thriving community or just exploring what Houston has to offer, there’s no denying that the city is a significant player in the wealth landscape.

What We’re Seeing at the Community Foundation

In our ongoing mission to empower philanthropic giving, the Community Foundation has been closely monitoring notable trends that shape the landscape of charitable donations. As we dive into the evolving philanthropic ecosystem, several key observations stand out:

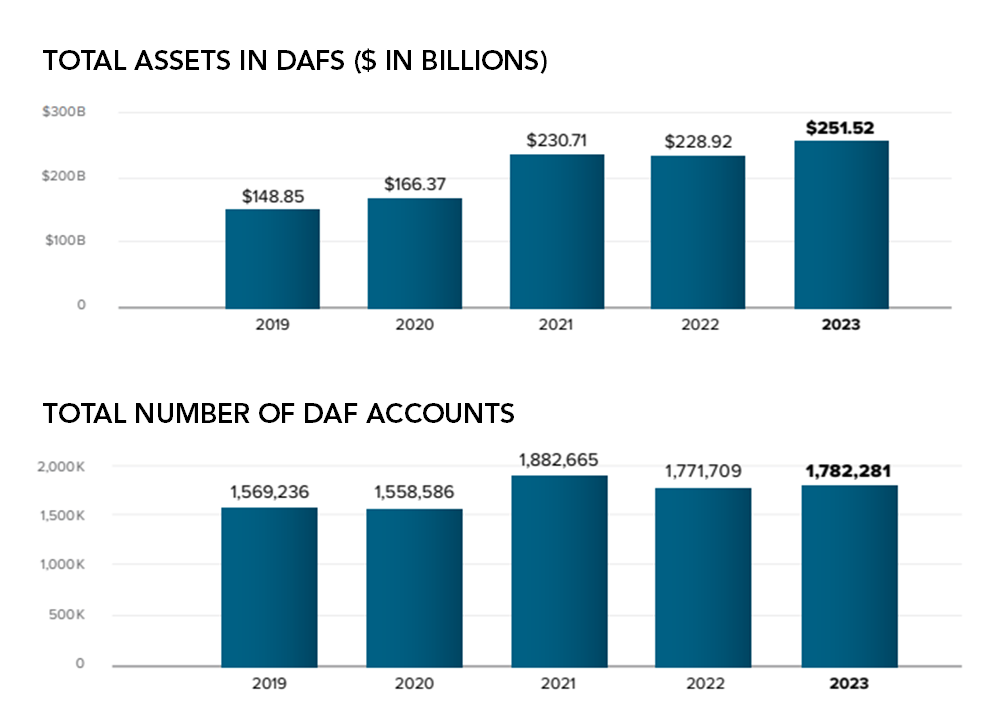

An Increase in Donor Advised Funds (DAFs): According to the National Philanthropic Trust, there has been a remarkable uptick in the use of donor advised funds. This growing interest demonstrates a shift toward more flexible and strategic giving options, enabling donors to make a lasting impact with their contributions.

Peer Networking and Collaboration: Donors are increasingly valuing peer networking and collaboration, realizing that collective efforts can amplify their philanthropic impact. By working together, donors can share insights, resources, and best practices, which ultimately enhances their effectiveness in driving change.

Evolving Strategies Without Losing Core Values: While the strategic approach to philanthropy may be evolving, we observe that many donors are not necessarily altering their core values, passions, or areas of focus. Instead, they are refining their strategies to align with contemporary challenges and opportunities in the philanthropic landscape.

Involvement Across Generations: We’re noticing a heartening trend among families: multiple generations are becoming more involved in their philanthropic endeavors. Particularly, millennials in their late 30s and early 40s are stepping into leadership roles, taking on decision-making responsibilities, and bringing fresh perspectives to family giving strategies.

Additionally, the Community Foundation has witnessed a surge in youth involvement in philanthropy, encompassing children, teenagers, and young adults alike. This new generation of givers is not only engaging earlier in the donating process but also demonstrating a strong commitment to making a tangible difference. Their proactive approach and willingness to participate actively in charitable initiatives signal a transformative era of socially conscious giving that includes youth of all ages.

A Data-Driven Approach to Giving: Donors today are increasingly leveraging data to inform their philanthropic decisions—a notable change from a decade ago. As donors become more analytical, there is also a rising trend in funding trust-based initiatives and general operating grants that empower organizations. This reflects a move toward long-term support rather than just project-based funding.

Focus on Systems Change & Long-Term Impact: More philanthropists are recognizing the importance of addressing the root causes of social challenges. By prioritizing systems change, many donors are now looking for opportunities to create scalable, long-lasting impacts that extend beyond immediate solutions. This strategic thinking sets the groundwork for sustainable progress in the communities they serve.

So, Why Is This Important?

As we reflect on the powerful insights shared throughout this series, it’s clear that we are living through a pivotal moment in philanthropic history. The great wealth transfer is not just a financial event—it’s a cultural, relational, and deeply personal opportunity. Understanding why this matters—and what role each of us plays—is essential for building a future rooted in generosity, shared values, and lasting impact.

For Donors:

Your generosity is more than a transaction—it’s a statement of who you are and what you believe in. This moment invites you to think beyond tax benefits and year-end giving, and instead lean into a broader, values-driven approach. Whether you’re just beginning to engage your children or grandchildren in giving or you’ve been stewarding your family’s legacy for decades, now is the time to be intentional. Bring your family to the table, talk openly about what matters, and consider how your donor advised fund or philanthropic investments can be tools to inspire—not just support—change across generations.

For Professional Advisors:

You sit at the intersection of wealth, planning, and purpose. Your clients are not only seeking financial guidance but are also looking for meaningful ways to connect their resources to their values. By helping families plan for charitable giving through conversations that include legacy, family dynamics, and community impact, you can deepen relationships and offer truly holistic guidance. Understanding trends in donor behavior, generational engagement, and community need helps position you as a trusted partner in a rapidly evolving philanthropic environment.

For Nonprofits:

The landscape of giving is shifting—and so are donor expectations. As younger generations step into leadership roles in family giving, they bring a desire for transparency, partnership, and results. By embracing trust-based philanthropy, sharing your organization’s long-term vision, and demonstrating how you create systemic change, you invite donors to see themselves as true collaborators. This is your moment to educate, inspire, and build deeper relationships that span generations.

Greater Houston Community Foundation is here to support every part of this journey—whether you are giving, guiding, or growing. Together, we can turn values into action and valuables into lasting impact.

Ready to start a conversation? Connect with the Community Foundation’s team of experienced philanthropic advisors to discover personalized strategies that align with your unique circumstances and goals. We invite you to connect with our team to get started.

More Helpful Articles by Greater Houston Community Foundation:

- What Is the Great Wealth Transfer?

- DAFs & Private Foundation’s: Addressing Common Misconceptions

- How to Start a Scholarship Fund

- The Team Approach to Philanthropy

This website is a public resource of general information that is intended, but not promised or guaranteed, to be correct, complete, and up to date. The materials on this website, including all comments and responses to comments, do not constitute legal, tax, or other professional advice, and is not intended to create, and receipt or viewing does not constitute, nor should it be considered an invitation for, an attorney-client relationship. The reader should not rely on information provided herein and should always seek the advice of competent legal counsel and/or a tax professional in the reader’s state or jurisdiction. The owner of this website does not intend links on the website to be referrals or endorsements of the linked entities.